Closing your TD Ameritrade account is a clear-cut procedure that necessitates a thorough understanding of the platform’s guidelines. Regardless of your level of investment experience, comprehending the steps to close your TD Ameritrade account is crucial for a smooth transition. TD Ameritrade, a well-established brokerage firm offering a diverse range of investment opportunities, facilitates account closures through a structured process designed to accommodate various circumstances. This guide will provide a detailed walkthrough of the steps involved in initiating and completing the account closure process, focusing on important aspects such as compliance with local regulations, effective communication through appropriate channels, managing existing investments, and upholding security protocols. Whether you’re adjusting your investment portfolio, consolidating accounts, or concluding your engagement with TD Ameritrade, this guide will assist you in navigating the closure process with ease and efficiency.

We will discuss several ways through which you could close your td ameritrade account

WITHDRAW FUNDS

To close your TD Ameritrade brokerage account and withdraw funds in the easiest way, especially via mobile devices, ensure you utilize their technical support. Whether it’s for a TD Direct Investing account or margin accounts, inquire about any such offer to close inactive accounts with an investment representative. If you’re using the Thinkorswim trading platform, they may guide you on initiating this process when opening a new account. Make sure to gather important information regarding regulations of that jurisdiction and how it applies to your account closure.

For a convenient way, inquire about the TD Ameritrade hotline phone number for assistance. They often provide multi-factor authentication for secure log-in, essential for transactions like day trading or margin trading. If you have a TD Ameritrade brokerage account or an IRA account, ensure you manage your cash balance effectively. For those in the United States, TD Ameritrade is a recognized financial institution, and they offer market orders for trading stocks and exchange-traded funds.

When dealing with TD Ameritrade’s services, consider their Thinkorswim desktop platform for more robust options trading. Always follow the correct procedures for closing your account, adhering to the regulations and ensuring the involvement of an investment advisor, especially during peak market demand. Check for online statements and be aware of their clearing processes for trades and initial public offerings.

If you need further assistance, don’t hesitate to contact TD Ameritrade’s customer service, either through their website or directly via the TD app, which also supports mobile check deposit. Additionally, TD Ameritrade has a presence in global currency markets, including a website dedicated to Singapore. Keep track of your account activity, especially for day trade or margin call scenarios. Lastly, remember that TD Ameritrade is a member of the Securities Investor Protection Corporation (SIPC), which provides certain protections to account holders.

To close your TD Ameritrade account and withdraw funds from a mutual funds brokerage account using a convenient and mobile-friendly approach, you should follow these steps:

- Review Local Regulations:

Familiarize yourself with the regulations in your specific jurisdiction, such as Hong Kong or Saudi Arabia, regarding account closures and fund withdrawals from financial institutions like TD Ameritrade.

- Contact TD Ameritrade Customer Service:

Reach out to TD Ameritrade’s client services through their customer support hotline or email address. For international clients, ensure you have the correct contact information for your region.

- Provide Necessary Information:

You may need to verify your identity and account ownership by providing personal information and your TD Ameritrade account details, including your account number and relevant account types (e.g., mutual funds, cash account).

- Request Withdrawal and Closure:

Clearly state your intention to close the account and request the withdrawal of funds from your mutual funds. Specify that you wish to maintain a zero equity balance.

- Choose Withdrawal Method:

Inquire about the available withdrawal options, such as transferring funds to your linked bank account or sending a check to your address.

- Complete Documentation:

If required, fill out any necessary forms for account closure, fund withdrawal, or account transfer application. Ensure all details are accurate and complete.

- Liquidate Investments:

If necessary, initiate the process to liquidate your mutual fund investments to facilitate the withdrawal of funds.

- Review Account for Zero Balance:

Confirm that your account shows a zero balance and there are no outstanding transactions, positions, or obligations.

- Securely Authenticate Transactions:

Utilize the TD Ameritrade mobile app, employing two-factor authentication for added security, to request withdrawals and authenticate transactions.

- Follow Up:

Stay in touch with TD Ameritrade’s customer service to ensure a smooth processing of your request. Inquire about the estimated time frame for fund disbursement into your bank account.

- Monitor Bank Account:

Keep an eye on your linked bank account to ensure the funds are deposited correctly and within the expected timeframe, typically within a few business days.

- Confirm Account Closure:

Confirm with TD Ameritrade that your account is closed and no longer active.

Remember to adhere to TD Ameritrade’s policies and procedures, and ensure compliance with the laws and regulations of your jurisdiction while proceeding with the closure of your account and withdrawal of funds.

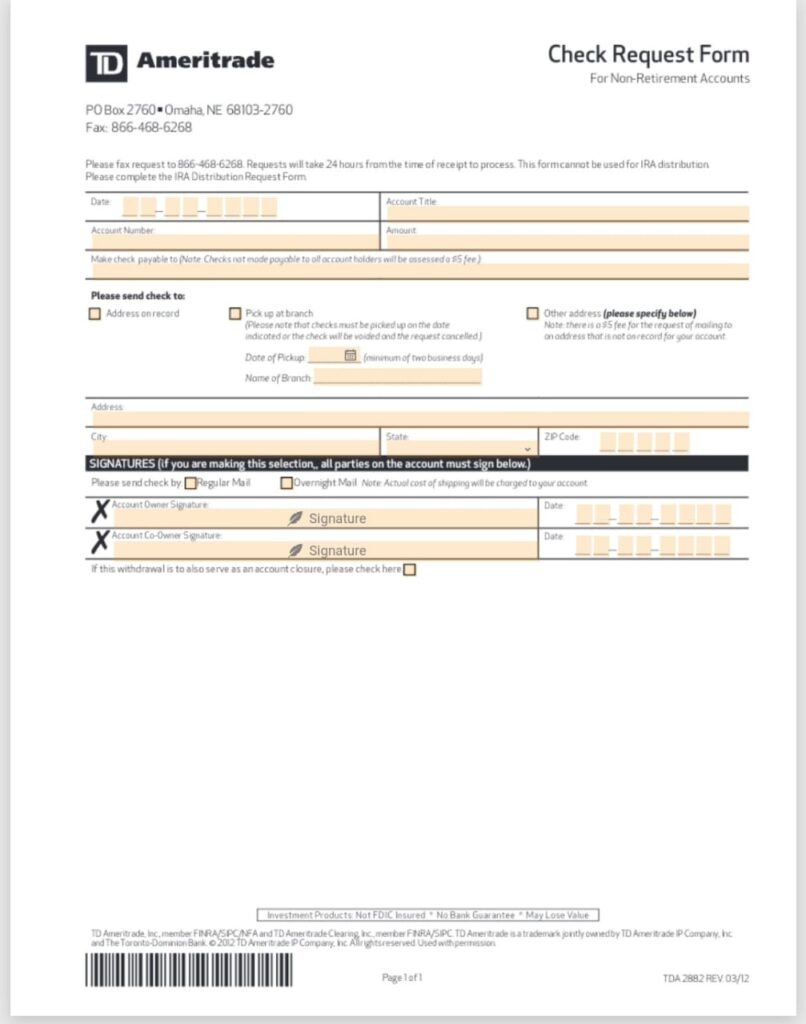

REQUEST FOR CHEQUE

To initiate the closure of your TD Ameritrade account and request a check, follow these steps:

- Contact TD Ameritrade Customer Service:

Reach out to TD Ameritrade, a reputable brokerage firm, through their customer service channels, such as their North American phone number, to begin the account closure process and inquire about the check request. - Understand Local Laws and Regulations:

Familiarize yourself with local laws and regulations that govern account closures and fund disbursements to comply with legal requirements in your jurisdiction. - Clarify Process for Check Request:

Inquire about the specific steps and requirements for requesting a check as part of the account closure process, especially if you have Schwab accounts. - Confirm Desktop Trading Platform Usage:

Ensure that any transactions or requests made on TD Ameritrade’s desktop trading platform, including closure requests, are correctly processed as part of the account closure procedure. - Verify Ownership of the Account:

Confirm the necessary steps to validate ownership of your account, as TD Ameritrade must verify the owner of your account for security and compliance reasons. - Explore Different Ways to Request:

Ask about the different ways to initiate the check request, including through webTD Ameritrade secure log-in or directly visiting the TD Ameritrade Singapore website if applicable. - Request a Check for IRA Accounts:

If your account is an IRA account, specifically request information on the procedure for closing such accounts and obtaining the funds via a check. - Maintain Security During the Process:

Discuss security measures, such as utilizing text-message security codes or other secure log-in methods, to ensure a safe transaction during the closing process. - Ensure Compliance with Third-Party Sites:

If dealing with third-party websites, ascertain that the requests for account closure and check issuance align with TD Ameritrade’s policies and procedures. - Monitor Notifications and Alerts:

Be mindful of any price alerts or notifications received, especially during the account closure process, as TD Ameritrade often provides important information through text messages or the web. - Coordinate with Charles Schwab & Co.:

If applicable, coordinate with Charles Schwab & Co. regarding Schwab brokerage accounts and follow their specific guidelines for account closures. - Be Mindful of Timing:

Consider the timing of your requests, especially avoiding peak times like Monday mornings, to ensure efficient processing. - Request Information on Direct Listings and Initial Public Offerings:

If you have investments related to direct listings or initial public offerings, request guidance on handling these investments during the account closure process. - Stay Informed About Memorial Day Weekend:

If your request falls near Memorial Day weekend, verify the working schedule and potential delays in processing during this time. - Note Column Headers for Transactions:

Pay attention to column headers or specific identifiers related to your active TD Ameritrade account number, especially when reviewing statements or transaction history.

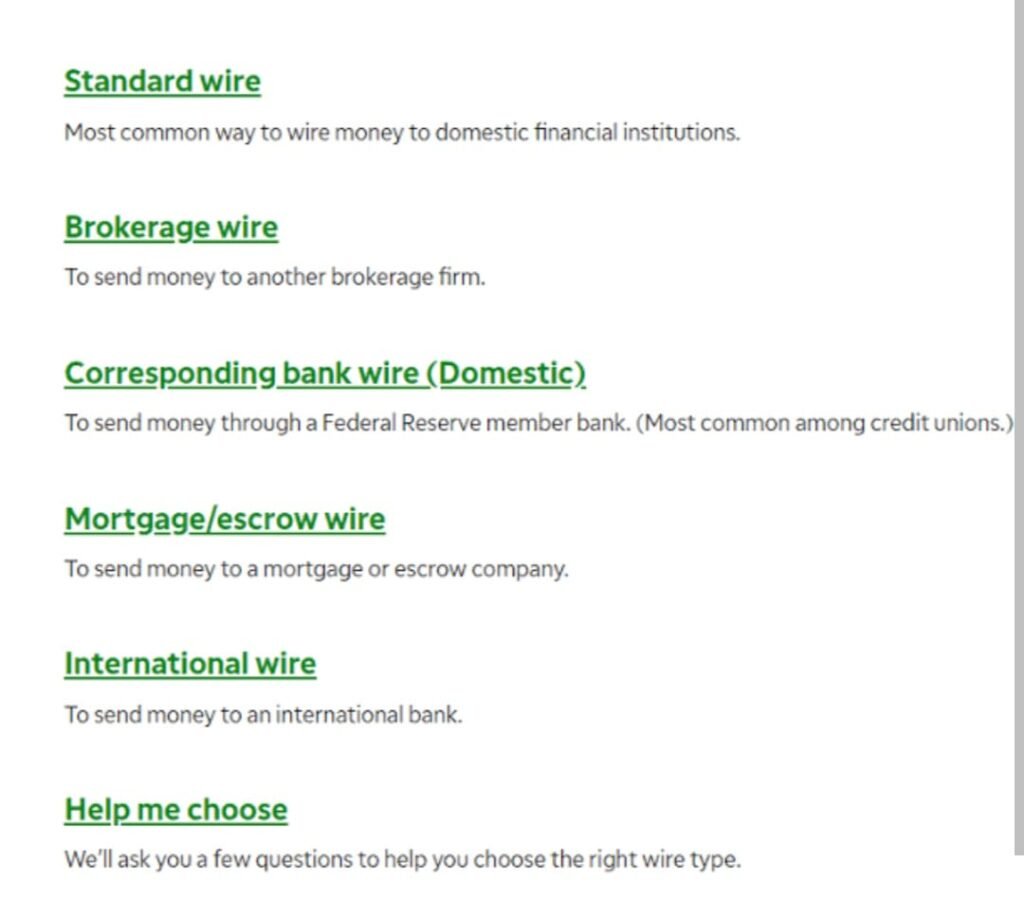

WIRE TRANSFER REQUEST FORM

To efficiently close your TD Ameritrade account and withdraw funds via wire transfer online, utilizing the Wire Transfer Request Form, follow these tailored steps:

Access Your TD Ameritrade Account:

Log in to your TD Ameritrade account through the brokerage firm’s website or the relevant trading platform accessible on both desktop and mobile devices.

Locate and Access the Wire Transfer Request Form:

Within the platform, find and click on the Wire Transfer Request Form, which allows you to request a wire transfer for funds, including those from mutual funds.

Provide Personal and Account Details:

Complete the form by entering your personal information and TD Direct Investing account details accurately.

Specify Wire Transfer Details:

Fill in the details for the wire transfer, including the recipient’s name, bank account information, and the amount to be transferred.

Select Wire Transfer as the Withdrawal Method:

Choose wire transfer as your preferred method to withdraw funds, aiming for the easiest and most convenient way.

Verify and Confirm Your Input:

Review all the provided information to ensure accuracy and completeness in compliance with local laws and regulations, particularly those applicable to Hong Kong and Saudi Arabia.

Authorize and Submit the Wire Transfer Request:

Confirm your authorization for the wire transfer request using two-factor authentication or any other required security measures. Submit the form securely.

Monitor Progress and Await Confirmation:

Keep track of your TD Ameritrade account for updates on the status of your wire transfer request and await confirmation of the transaction.

Check Receiving Account for the Transfer:

Regularly check your receiving bank account to verify that the funds from your TD Ameritrade account have been successfully transferred.

Seek Technical Support if Needed:

If you encounter any technical difficulties during this process, reach out to TD Ameritrade’s technical support for guidance and assistance.

Contact Client Services for Additional Support:

If you have further questions or need assistance in navigating through the wire transfer process, contact TD Ameritrade’s client services for support.

Close Inactive Accounts and Maintain a Zero Balance:

Ensure that you close any inactive accounts with a zero balance to comply with TD Ameritrade’s policies and regulations of the respective jurisdiction.

.

CONTACT TD AMERITRADE

To initiate the closure of your TD Ameritrade account and utilize the appropriate keywords, follow these steps to contact TD Ameritrade:

Access TD Ameritrade Contact Information:

Visit the official TD Ameritrade website to obtain the correct contact details, including phone numbers and email addresses, to reach their customer service.

Call Customer Support Directly:

Use the provided TD Ameritrade customer support phone number to speak directly with a representative about closing your account. This can be done during their regular operating hours, avoiding peak times like Monday morning.

Request Account Closure:

Clearly state your intention to close your TD Ameritrade account during the call. Mention that you are a TD Ameritrade customer and emphasize the need to proceed with the closure.

Provide Necessary Account Information:

Be ready to provide essential account details, such as your Thinkorswim account information or any other relevant identifiers that confirm your association with TD Ameritrade.

Ask About the Closing Process:

Inquire about the specific steps involved in closing your account, including any paperwork or digital forms that need to be completed. Also, ask about TD Ameritrade clearing procedures in this context.

Discuss Direct Listing and Initial Public Offering:

If you have investments related to a direct listing or initial public offering, ask about their treatment during the closure process.

Address Concerns About Third-Party Sites:

If you have concerns about third-party websites or any third-party involvement, make sure to communicate this and ask for clarification on their role in the account closure.

Verify Security Measures:

Discuss security measures such as text-message security codes to ensure that the closure process maintains a high level of security.

Ask About Financial Advisor Involvement:

If you have a financial advisor associated with your TD Ameritrade account, ask how their involvement affects the closing of your account.

Inquire About Wells Fargo Bank Transactions:

If your TD Ameritrade account is linked to Wells Fargo Bank, discuss how this may impact the closure and fund transfer process.

Discuss International Account Closure:

If you reside in a country within the European Union, ask about any specific requirements or considerations for international account closure.

Request Confirmation and Next Steps:

Seek confirmation that the account closure process has been initiated and request information regarding the timeline and any further actions you need to take, such as using the web to request closure.

Follow Up on Progress:

After the initial contact, monitor your account and reach out for updates if necessary, ensuring a smooth closing process.

Conclusion

In conclusion, managing your TD Ameritrade account closure is a fundamental aspect of your financial journey. This guide has illuminated the necessary steps and considerations for a successful closure, emphasizing compliance with legal regulations, efficient communication with the brokerage firm, addressing existing investments, and maintaining security measures throughout the process.

As you embark on this account closure, make sure to follow the provided steps diligently, ensuring a smooth transition and safeguarding your financial interests. Whether it’s to reallocate assets, streamline your investment portfolio, or conclude your tenure with TD Ameritrade, informed and meticulous account closure is essential.

Your financial decisions are pivotal, and concluding your engagement with TD Ameritrade should align with your broader financial objectives. Remember, a well-managed account closure is a testament to your financial prudence and sets the stage for future investment endeavors.

Check out our other articles like HOW TO WITHDRAW MONEY FROM TD AMERITRADE ACCOUNT for more personal finace tips