Through this article we aim to guide you on how to efficiently withdraw funds from your TD Ameritrade account. Managing your finances and executing withdrawals is an important aspect of having a TD Ameritrade account. Whether you’re dealing with various account types, such as cash accounts or margin accounts, or considering the implications of withdrawing from mutual funds, understanding the procedures and complying with local laws and regulations should be your top priority .

This guide will walk you through the steps, withdrawal methods like ACH transfers and wire transfers, the importance of adhering to business days, and other essential aspects like utilizing a debit card and seeking legal advice when needed. At the end we hope you are independently able of withdrawing funds from your TD Ameritrade account while ensuring compliance and efficiency in accordance with the regulations.

Step by Step guide to withdraw money from td Ameitrade account

1. Accessing Your TD Ameritrade

- Start by opening a web browser and visiting the official TD Ameritrade website at www.tdameritrade.com. Log in using your unique credentials, including your username and password.

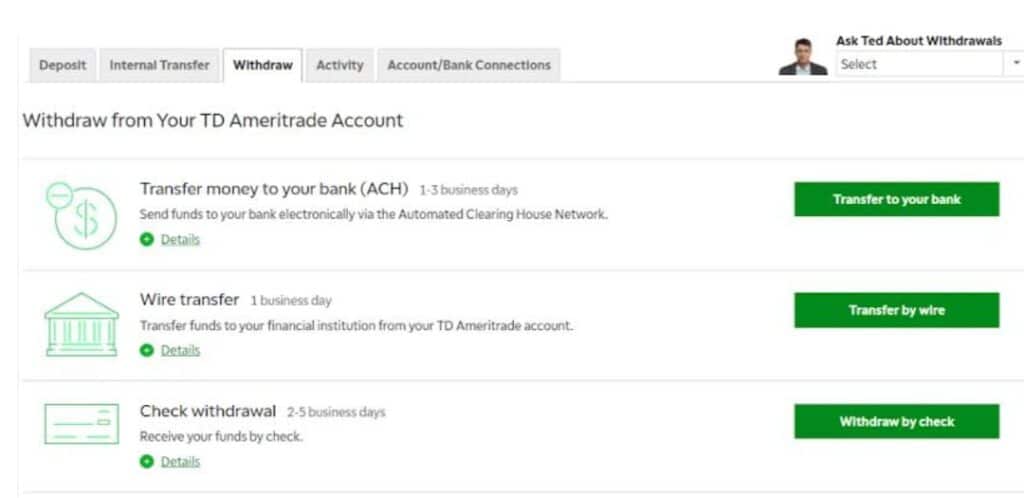

2. Locating the Transfers & Withdrawals Section:

- Once logged in, find the section usually labeled as “Transfers & Withdrawals” on your account dashboard. You can typically access this through your account or profile settings.

3. Selecting the Withdrawal Option:

- Within the “Transfers & Withdrawals” section, select the option that enables you to make a withdrawal.

4. Choosing the Withdrawal Method:

- TD Ameritrade offers a variety of withdrawal methods, including electronic funds transfer (ACH transfer), wire transfer, or check.

- For an ACH transfer, select this method and proceed to provide the necessary bank account details.

5. Specifying the Withdrawal Amount and Currency:

- Input the amount you wish to withdraw from your TD Ameritrade account. Ensure the amount is within the limits of your available account balances.

6. Providing Required Information:

- If opting for an ACH transfer, furnish the essential bank account details such as account number and routing number. Ensure that the bank account is in a compatible currency for the withdrawal.

7. Reviewing and Confirming Details:

- Thoroughly review all provided details, including the withdrawal amount, chosen withdrawal method, and provided bank account information to ensure accuracy and compliance with local laws and regulations.

8. Authorizing the Withdrawal:

- Authorize your request to withdraw funds by providing the necessary authorizations or security verifications, which may involve using a secure code or responding to security questions.

9. Understanding Processing Time and Business Days:

- Be aware that processing times for withdrawals vary based on the chosen method. ACH transfers typically take a few business days to reflect in your bank account. Business days typically exclude weekends and public holidays.

10. Monitoring Your Bank Account:

- Keep a close watch on your bank account to ensure that the funds are deposited within the stipulated processing time.

Available Withdrawal Methods at TD Ameritrade

TD Ameritrade offers a variety of withdrawal methods to provide flexibility to its clients when accessing their funds. Understanding these methods and associated terms is crucial for efficient fund management.

The processing time for withdrawals from your TD Ameritrade account varies based on the chosen withdrawal method and other relevant factors. Understanding the details of each method is essential to manage your expectations regarding processing duration.

1. ACH Transfer (Electronic Funds Transfer):

– ACH transfers typically take a few business days to reflect in your bank account, excluding weekends and public holidays.

– Factors affecting processing time include your bank, ongoing holidays, and the day of the week you initiate the transfer.

2. Wire Transfer:

– Wire transfers usually process within one to two business days.

– Factors affecting processing time include the efficiency of the receiving bank and potential time zone differences.

3. Check Withdrawals:

– The total processing time for check withdrawals includes processing by TD Ameritrade and postal delivery time to your location.

– Factors affecting processing time include postal services and your location.

4. Debit Card Withdrawal:

– Debit card withdrawals offer instant access to funds once the transaction is approved.

Fees for Ameritrade Money Withdrawal:

TD Ameritrade generally does not impose fees for standard ACH (Automated Clearing House) withdrawals, making it a prevalent and cost-effective method for transferring funds. However, certain fees might apply to wire transfers and check withdrawals, depending on variables such as withdrawal amount, method, and account type. For the most up-to-date information on withdrawal fees, refer to TD Ameritrade’s official website or contact their customer service.

For effective financial management, prospective investors should explore the various TD Ameritrade account types available, including margin accounts and retirement options.

Take advantage of TD Ameritrade’s current promotional offer, providing you with exciting benefits when utilizing these withdrawal methods. Don’t miss out on this opportunity for enhanced financial management and accessibility to your funds!

How much time will it take to process the withdrawal?

The processing time for withdrawals from your TD Ameritrade account can vary based on the withdrawal method you choose and other relevant factors. It’s essential to understand the intricacies of each withdrawal method to manage your expectations regarding processing duration.

The processing time for withdrawals from your TD Ameritrade account can vary based on the withdrawal method you choose and other relevant factors. It’s essential to understand the intricacies of each withdrawal method to manage your expectations regarding processing duration.

1. ACH Transfer (Electronic Funds Transfer):

ACH transfers are a commonly chosen method due to their convenience and ease of use.

Processing Time: ACH transfers typically take a few business days to reflect in your bank account. Business days usually exclude weekends and public holidays.

Factors Affecting Processing Time: The time taken can vary based on your bank, any ongoing holidays, and the day of the week you initiate the transfer.

2. Wire Transfer:

Wire transfers are expedited for swifter fund transfers, particularly for larger amounts.

Processing Time: Wire transfers usually process within one to two business days.

Factors Affecting Processing Time:** The efficiency of the receiving bank and potential time zone differences can impact the speed of the transfer.

3. Check Withdrawals:

Check withdrawals involve the issuance and delivery of a physical check to your registered address.

Processing Time: The total time for check withdrawals includes processing by TD Ameritrade and the postal delivery time to your location.

Factors Affecting Processing Time: Postal services and your location significantly influence the overall processing duration.

4. Debit Card Withdrawal:

Utilizing a TD Ameritrade-linked debit card for withdrawals is convenient and provides immediate access to funds.

Processing Time: Debit card withdrawals offer instant access to funds once the transaction is approved.

Fees needed for ameritrade money withdrawl

TD Ameritrade, generally does not impose fees for standard ACH (Automated Clearing House) withdrawals, which is the prevalent method for transferring funds from your TD Ameritrade brokerage account to your linked bank account. It’s worth highlighting that ACH transfers are free of charge, representing a common and convenient option for withdrawing funds.

However, it’s crucial to be aware that certain fees might apply to wire transfers and check withdrawals, contingent on variables such as the withdrawal amount, method of withdrawal, and your specific account type. For the most current and accurate details regarding withdrawal fees, it’s highly advisable to refer to the fee schedule provided on TD Ameritrade’s official website or contact their customer service.

For financial management, prospective investors should consider the different TD Ameritrade account types available, including margin accounts and retirement

Some important points to remember

1. Account Types and Balances:

– TD Ameritrade offers various account types like cash accounts and margin accounts.

– Understanding account balances and restrictions specific to your account type is crucial.

2. Mutual Funds:

– Familiarize yourself with the withdrawal process and implications when withdrawing from mutual fund investments within your TD Ameritrade account.

3. Regulations and Compliance:

– TD Ameritrade operates under specific regulations and guidelines as a brokerage firm.

– Being aware of these regulations is vital for making informed financial decisions within the legal framework.

4. Debit Card Usage:

– TD Ameritrade may provide a debit card option linked to your account.

– Thoroughly review the terms and conditions associated with its usage for a clear understanding of fees, transaction limits, and features.

5. Customer Service and Legal Advice:

– Reach out to TD Ameritrade’s customer service for any inquiries or assistance related to withdrawals.

– Consider seeking legal advice from a professional well-versed in financial regulations for complex financial transactions or substantial account balances.

6. Compliance with Local Laws:

– Understand and adhere to local laws and regulations, especially for clients in jurisdictions like Hong Kong or Saudi Arabia.

– Compliance ensures that financial transactions, including withdrawals from TD Ameritrade accounts, are conducted in accordance with the law, mitigating risks and legal complications.

7. Margin Account Considerations:

– If you have a margin account, familiarize yourself with specific rules and implications related to withdrawing funds from this type of account.

8. Financial Institutions and Offer Availability:

– Depending on your location, certain withdrawal options may be limited based on the availability of financial institutions.

– TD Ameritrade may have specific offers or promotions related to withdrawal methods; stay informed to choose the most suitable option.

Special Risks and Important Information

Before initiating a withdrawal, familiarize yourself with any special risks and important information related to your account. Being aware of these factors can guide your decisions.

Best Way to Withdraw

Selecting the best way to withdraw funds is crucial. Evaluate options like ACH transfers, wire transfers, or check withdrawals. ACH transfers, being fee-free and processed within a few business days, are often a preferred choice.

Considerations with Brokerage Services

Brokerage services play a vital role in facilitating your withdrawals. TD Ameritrade offers a range of withdrawal methods, and understanding the implications and associated fees is essential for informed decisions.

Gift Card and Non-Marginable Securities

Ensure you’re clear on the nature of your assets. Non-marginable securities and gift cards might have restrictions on withdrawal. Be mindful of these before proceeding.

Efficient Trading Day

Choose an efficient trading day for your withdrawal. Consider market demand and trends to make an informed decision about when to initiate the withdrawal.

IRA Account and Rollover Options

For investors with an IRA account, exploring rollover options is advisable. Understanding the potential tax benefits associated with rolling over funds into an IRA can optimize your financial strategy.

European Union Regulations

If you’re in countries of the European Union, be mindful of the specific regulations that might impact the withdrawal process. Compliance is crucial to avoid any legal complications.

Cash Management and Investment Products

Review your cash management accounts and other investment products. Assess how your withdrawal aligns with your overall financial strategy and investment goals.

Customer Assistance and Smooth Withdrawal:

TD Ameritrade offers customer assistance for a smooth withdrawal process. If you have pending transactions or need guidance, reaching out to their customer service can be invaluable.

By incorporating these considerations and being informed about special risks, the best withdrawal methods, brokerage services, and regulatory implications, you can confidently manage your TD Ameritrade account withdrawals. Tailor your approach based on your unique financial situation and stay updated with the latest information to make the most of your investments.

MAINTAINING THE TD AMERITRADE ACCOUNT

Efficiently managing your TD Ameritrade account is essential for successful trading and investment. Understanding account types, regulations, and utilizing features like ACH transfers and debit cards are key steps. Opt for the appropriate account type—cash or margin account—based on your risk tolerance and preferences. Regularly review your account balances and stay updated on market trends. Leverage the diverse features provided by TD Ameritrade for seamless fund access. Utilize available resources and seek advice when needed to enhance your account management experience. Successful trading involves careful consideration of account types and compliance with regulatory guidelines

What to be cautious about

When initiating a withdrawal from your TD Ameritrade account, it’s important to navigate the process with care and attention to various details to avoid potential mistakes. Here are key considerations to remain cautious about:

- Understanding Account Types and Balances:

- Mistake: Initiating a withdrawal without considering your specific account type and available balance.

- Caution: Different account types may have varying rules regarding withdrawals and may require maintaining a minimum balance.

- Awareness of Withdrawal Duration:

- Mistake: Expecting immediate withdrawal, disregarding the standard processing time in business days.

- Caution: Understand that withdrawals may take several business days to reflect in your linked bank account.

- Choosing the Right Withdrawal Method:

- Mistake: Opting for a withdrawal method without considering associated fees, transaction times, or restrictions.

- Caution: Evaluate each method’s pros and cons, such as potential fees for using a debit card or the convenience of ACH transfers.

- Knowledge of Local Laws and Regulations:

- Mistake: Overlooking the local laws and regulations that may impact the withdrawal process.

- Caution: Ensure compliance with local laws to avoid legal complications, especially in jurisdictions like Hong Kong or Saudi Arabia.

- Risks Associated with Investments:

- Mistake: Not considering the potential impact of a withdrawal on your investment portfolio.

- Caution: Understand how withdrawals might affect your investment strategy, especially when dealing with mutual funds or options trading.

- Check Withdrawal Accuracy:

- Mistake: Not double-checking the details when opting for a check withdrawal.

- Caution: Verify the accuracy of the provided information to avoid delays or issues with the check.

- Considering the Rollover IRA:

- Mistake: Not exploring the option of rolling over funds into an IRA for potential tax benefits.

- Caution: Assess the advantages of a Rollover IRA and consult a tax advisor to make an informed decision.

- Seeking Legal Advice and Customer Service:

- Mistake: Failing to seek legal advice or customer service assistance when unsure about the withdrawal process.

- Caution: Reach out to TD Ameritrade’s customer service or consult a legal advisor to clarify any doubts and ensure a smooth withdrawal process.

Being cautious about your account type, withdrawal duration, chosen method, adherence to laws, potential risks, accuracy of check withdrawals, considerations for a Rollover IRA, and seeking appropriate advice can help you navigate TD Ameritrade’s withdrawal process effectively and avoid costly errors. Always prioritize understanding the implications of your actions and seek assistance when needed.

CONCLUSION

In conclusion, efficiently managing your TD Ameritrade account and facilitating smooth withdrawals involves a good understanding of the array of withdrawal options .

ACH transfers, a primary choice for withdrawing funds, are typically fee-free and are processed within a few business days. For more immediate access to your funds, linking your bank account or utilizing a debit card could be doable options.

You must remain well-informed about any potential fees and associated processing times. Evaluating account types, such as margin accounts or retirement accounts like Rollover IRAs, is essential. Additionally, carefully assessing account balances and potential risks linked to options trading and other investments is vital.

Reading local laws and regulations in your jurisdiction, particularly if you’re located in regions like Hong Kong or Saudi Arabia, is important for compliance and risk management.

Maintaining your TD Ameritrade account is paramount for successful financial management. Regularly review your account type, stay updated on market trends, and utilize the platform’s features for seamless fund access. Explore available resources and seek guidance when needed to enhance your account management experience and make informed financial decisions.

TD Ameritrade’s customer service is readily available to provide assistance when needed, and seeking legal advice is always a prudent step when dealing with intricate financial matters.

Stay updated of the latest updates and utilizing features like the mobile application for real-time data can enhance your overall experience in managing your investments through TD Ameritrade.

Your guide to voiding an invoice in your quickbook check this blog out for more personal finance tips.