Earning money through online channels may seem simple at first glance but engaging in online trading on the North American Derivatives Exchange (NADEX) is quite challenging. The financial markets offer a variety of avenues for participation, some of which involve predicting market movements. NADEX trading is one such method, characterized by its simplicity but also its high level of risk. Successful trading on NADEX requires in-depth knowledge and the implementation of effective strategies. This blog will give an insight into How to make money on Nadex: 12 Powerful steps

What is Nadex?

The North American Derivatives Exchange (Nadex) is prominent in the United States specializing in binary options trading, call spreads, and knockouts, providing secure and innovative methods for engaging in the financial markets. Nadex is subject to regulation by the Commodity Futures Trading Commission (CFTC), ensuring compliance with industry standards, and client funds are held in segregated accounts in major US banks for added security.

Initially known as “HedgeStreet,” Nadex was headquartered in San Mateo, California. The exchange was established in 2004 as an electronic marketplace catering to retail investors interested in trading financial derivatives. However, HedgeStreet ceased operations in late 2007. Subsequently, UK-based IG Group Holdings plc. acquired HedgeStreet, Inc. for $6 million and initiated a comprehensive exchange overhaul, including its technology and product offerings. 2009 the restructured exchange was rebranded as the North American Derivatives Exchange (Nadex).

The trading hours for Nadex start at 6:00 p.m. ET on Sunday and continue overnight until 5:00 p.m. ET Monday through Thursday. On Fridays, trading ends at 4:15 p.m. ET. During each trading day, there is a one-hour pause from 5:00 p.m. ET to 6:00 p.m. ET for exchange maintenance and to settle contracts.

Nadex offers a variety of derivative contracts, one of the most popular being the binary options. These options are based on a simple yes or no proposition, where traders bet on whether an underlying asset will be above or below a certain price at a specific time. What’s unique about binary options is that they have well-defined profit and loss limitations that are known in advance. This characteristic makes them an attractive choice for many traders and newcomers to the financial markets.

| Platform | Web browser platform can be used on PC, Mac, and mobile browsers |

| Account Minimum | An initial deposit of $250 is required to open new accounts |

| Asset groups | Binary options contracts are available for stock indices, forex markets, commodities, and U.S. macroeconomic events. There is also Nadex call spreads which are unique financial instruments that allow you to speculate on markets without taking ownership of underlying assets |

| Mobile App | No mobile app is available on Google Play or Apple App Store |

| Available Account Types | Standard trading accounts for binary options, call spreads, and knock-outs. Free demo accounts are available with a starting balance of $10,000 in virtual cash; business accounts are also available |

Nadex Instruments

Nadex provides traders with a diverse range of trading instruments to meet varying investment strategies. These instruments include binary options, knock outs, and call spreads. Let’s take a closer look at each of them:

Binary options: Binary options are contracts with only two possible outcomes – a yes or no scenario. For instance, traders might speculate whether the price of silver will surpass $30 by December 2024. Upon expiration, if the contract is out-of-the-money, the trader receives $0; if it’s in-the-money, the trader receives $100 per share. This binary structure is the reason they are called binary options.

Knock-outs: Knock-outs, also known as touch brackets, are a knock-out contract that allows traders to set both a ceiling and floor on their trade. If either of these levels is reached, the trade is knocked out. This feature functions similarly to a stop-loss or take-profit order. Knock-outs can be held until expiration or sold earlier, but they have a maximum duration of one week.

Call spreads: Similar to knock-outs, call spreads require traders to set a ceiling and floor as initial trade parameters. However, unlike knock-outs, there is no risk of being knocked out of a call spread trade. Traders have the flexibility to keep the trade open for longer than a week or close it out early to lock in profits or minimize losses.

Your money is secure, and withdrawals are easy

Members engaged in trading have their funds stored in segregated accounts at prominent US banks. Upon becoming a member, your funds are placed in accounts with BMO Harris Bank and Fifth Third Bank in compliance with CFTC regulations. Additionally, withdrawing funds from your Nadex account is straightforward. You have three options for withdrawing your deposited funds:

– Debit card – complimentary for all Nadex members

– ACH withdrawal (bank transfer) – complimentary for US residents

– Wire transfer or international bank transfer for all international members

Trading on the Nadex Platform

To start trading binary options on the Nadex platform, you can follow these clear and easy steps:

1. Account setup and Access the Platform

To get started, you need to log on to the Nadex platform. The sign-up process is straightforward and free, and you even have the option to get a demo account with virtual funds for practice. Upon signing up, new users automatically receive $10,000 in virtual funds to explore the platform without any real risk. However, to protect user accounts, some US and most non-US applicants will need to verify their identity or residential address by providing the required documents.

2. Choose Your Asset

Utilize the Asset Finder tool located in the left sidebar window to select your desired asset. The assets are categorized by class, asset, and expiry, making it easy for you to find what you’re looking for.

3. Select the Expiry

Upon clicking on your chosen asset class and asset, the expiry information will be displayed. Click on your preferred expiry to view the available strike prices.

4. Choose the Strike Price

The main window lists the available strike prices. Typically, the most heavily traded strikes are those closest to the asset’s current price. By clicking on a strike price, you can access the order ticket.

5. Create Your Order Ticket

The order ticket contains essential details such as the expiry time, strike price, bid/offer prices, and market depth. At this stage, you have the option to buy or sell, specify the number of lots, and set the price you are willing to pay.

6. Monitor Your Trade

After your order is executed, it’s important to monitor your trade. You can hold the position until expiration, receive a full payout, or decide to exit the position at any time by buying or selling. This flexibility enables you to manage your trades effectively, whether to cut losses or capture profits.

How to make money on Nadex: 13 Powerful steps

For serious investors, following rules governing investment decisions is essential. These rules encompass using longer-term expiry, avoiding premature entries, limiting the number of assets traded, controlling risk exposure, and being adaptable in trade decisions. Other strategies for making money on Nadex include comprehending market movements, managing losses effectively, and paying attention to the spread. It is advised to abstain from using limit orders, use discretion when in profit, and avoid holding on to positions for too long.

Understanding trade execution and becoming familiar with the platform is crucial to avoid costly mistakes. Successful trading on Nadex and attaining profits necessitate employing these valuable Nadex trading strategies.

Risk is ok, but not all or excessive risk

When engaging in trading, it’s important to consider risk management and price levels. While taking big risks in the hope of greater returns may seem tempting, this approach can be detrimental. Many novice traders make the mistake of overexposing themselves to risk with each trade. It’s essential to remember that risking more than you can afford to lose can lead to significant losses and potential regrets. Protecting your capital should be a top priority when trading.

Instead of taking excessive risks, only a reasonable percentage of your capital should be exposed through calculated risk-taking. Gaining knowledge about risk exposure and implementing strategies to mitigate maximum loss can greatly benefit your trading endeavors.

Learn the Market Movements

Understanding the intricacies of your Nadex trade is paramount. The financial market can be harsh to ill-informed traders. Conducting thorough research to comprehend the reasons behind market movements and familiarizing yourself with the behavior of your chosen assets is crucial.

Enhanced knowledge empowers you to succeed. Achieving success in trading requires a deep understanding of the market. Jumping into trading without adequate preparation is ill-advised. Extensive research on your chosen trade, comprehensive market understanding, and the ability to make well-informed speculations about its movement are indispensable for trading success. Be aware of the historical data and the past performance of the market that you invest for.

Flexible in trading decisions is a must

The financial market is constantly in flux, with daily fluctuations and varying levels of volatility. This dynamic nature necessitates a flexible approach to trading decisions. It’s important not to rigidly adhere to a single strategy; rather, one must adapt to the prevailing market conditions. Some days are characterized by heightened activity, increased volatility, and stronger signals, while others may be marked by a lackluster performance and slow movement. Understanding these distinctions and being able to employ the appropriate strategy for each market condition is crucial for achieving long-term success. An effective trading strategy should be adaptable and responsive to the ever-changing reality of the market environment.

Avoid trading on multiple assets

When it comes to trading, one golden rule to keep in mind is to only invest what you can afford to lose. Trading too many assets simultaneously, particularly when engaging in short-term trading with 5-minute and 20-minute expiry times, can result in missed opportunities for profitable signals and selling options. Have an eye on the bollinger bands as they highlight times when there is little market volatility, which might mean less chance of buying low and achieving a bigger profit

While the range of assets available for trading on Nadex is vast, as Nadex customers it’s essential to acknowledge that your trade balance may not stretch to cover all assets at the same time. Overextending yourself in this manner can significantly elevate your risks, potentially leading to the loss of your invested capital. Therefore, it’s prudent to trade only with funds that you are comfortable with losing.

Attempting to juggle a large number of assets can also lead to information overload, commonly referred to as analysis paralysis, which can detrimentally impact your decision-making and overall trading performance. By limiting the number of assets you trade, you can enhance your likelihood of executing successful trades on Nadex.

Don’t start with actual money

One crucial aspect for new traders to grasp is understanding market movements before committing real money to trading. Many traders often make the mistake of jumping into trading with actual funds before acquiring the necessary knowledge and experience.

Fortunately, Nadex offers a valuable solution in the form of a free demo account, allowing users to practice trading within a risk-free environment. The demo account provides virtual funds specifically tailored for beginners to execute trades without any financial risk. By implementing your trading strategies and assessing the results, you can determine your readiness to transition to real-money trading.

It’s essential to continue learning and practicing on the demo platform until you observe significant improvement in successful trades. Many traders overlook the significance of becoming proficient with the trading platform before engaging in live trading and reaping profits.

Recognizing the significance of demo trading, Nadex provides a fully funded demo account with virtual funds of up to $10,000, ensuring that actions on the demo platform have no impact on your real financial account. This platform offers a safe space to test and refine your trading strategies to gauge their effectiveness. The primary objective of the demo account is to equip you with the skills and confidence required to engage in live trading successfully.

Choosing the right Strike price

Selecting the Strike Price Range: Nadex call spreads differ from traditional options by offering a range of strike prices. Choose the range that aligns with your market analysis and risk tolerance. Buying or Selling: After selecting your market, expiration, and strike price range, you can decide to buy or sell a Nadex call spread.

Stay abreast of current market conditions and trends. Keep up with world events, economic updates, and technical analyses. Nadex presents available strike prices for contracts expiring at predetermined times. Choose a strike price that is closest to your prediction. The main window lists strike prices, with the most actively traded ones near the current price of the asset.

Exercise caution and avoid excess thinking. If your signal is robust, consider purchasing a strike that is out-of-the-moneyOne can make maximum profit by understanding Nadex’s best interest and gaining proper knowledge. The outcome of your trade hinges on the strike price. Weighing Risk and Probability: In-the-money (ITM) strikes offer lower payouts but have a higher probability of success. Out-of-the-money (OTM) strikes come with higher payouts but lower probabilities. Select a strike that balances risk and potential returns.

Sell at the time of profit

Trading isn’t about waiting for profits to grow over time before selling. If the price is right and you’re in profit, the best time to sell was yesterday. Waiting for profits to increase might lead to them diminishing, causing a total loss. As options near their expiry date, both in-the-money and out-of-the-money options will lose any profits and their value. Therefore, it’s better to sell now rather than wait.

It’s crucial to understand that the market operates in real-time; what you see is what you get. It’s wise to take what you’ve earned when you’re in profit. Small profits can significantly affect your account over time. Aiming for higher profits doesn’t guarantee success; a profitable trade can quickly turn into a substantial loss. By understanding Nadex’s best interest and gaining proper knowledge one can make maximum profit.

Spread is mandatory

In Nadex, all prices are presented with a bid/ask spread. The bid represents the price at which buyers are willing to purchase, while the ask is the price at which sellers are willing to sell. If you purchase at the market price, you are effectively buying at the ask price. As the bid price is typically lower, an automatic loss may be incurred in your account, even if the option is profitable. Nadex (North American Derivatives Exchange) offers call spreads, which are contracts designed for short-term binary options trading.

Also, it’s important to note that the spread can fluctuate due to market pressure, so it’s essential to be mindful of these changes. The spread is often influenced by market pressure, and it’s crucial to closely monitor it to optimize your trading strategy and minimize costs when entering the market.

Analyse the bear and bull movement

Understanding the concepts of bullish and bearish movements is essential in Nadex trading.

– Bullish: A bullish trend means an upward movement in a specific asset. Bulls believe that the markets will rise. For example, if a trader says, “I’m bullish on gold,” they anticipate that the price of gold will increase.

– Bearish: A bearish trend indicates a downward movement in an asset. Bears expect the market to decline. If a trader says, “I’m bearish about crude oil going into the summer,” it means they think the price of crude oil will decrease in the early weeks of summer.

Bull vs. Bear Markets:

– A bull market typically refers to stock indices when prices are rising. If the price of a stock index (such as the Dow or S&P 500) is generally increasing, it’s considered a bull market.

– Conversely, a bear market occurs when an index’s price falls for an extended period (usually at least 20%). Short-term dips of 10-20% are considered corrections.

– It’s important to distinguish between bull markets and economic expansions. A bull market can exist without economic expansion, and a bear market can occur without a recession.

– Notable bull markets include the periods of 1925-1929, 1993-1997, and the recent one from 2009 to early 2020.

– Sometimes bull markets transition to bear markets and vice versa, as seen during the tech boom of the 1990s and the subsequent dot-com bubble burst.

In summary, understanding bullish and bearish trends is crucial for traders to make informed decisions in the financial markets.

Limit Orders to be avoided

When limit orders are used improperly, they can be harmful to the trader. Limit orders are designed to cause entry to happen automatically when the market hits a particular level. Even though they could have advantages, it’s advisable to avoid utilizing them when you first start out. Your urgent demands will be met via manual trade entries.

Limit orders serve two functions. They can, on the one hand, guarantee a loss if the market goes against you and assist you in getting a fair price when the market moves in your favor. Experts advise against using limit orders initially. Before you enter a trade, you must pay great attention to detail and wait for your signals.

Grab the money at the time of profits

How can someone who wants to make money turn down gains when they’re staring them in the face? It is not logical. It’s preferable to make a small profit in trading than a large loss. Small wins compound into large gains, but large losses drive you out of the market. Consider a scenario in which you have a closed position that is profitable. Rather than taking profits, you choose to stick onto the position until expiration in the hopes that profits may rise. As a result, you end up losing money.

You could punish yourself for employing a trading method that is so incorrect. On the other hand, in certain trading options, this kind of approach may succeed. But being able to recognize when to use these strategies is what distinguishes a skilled trader.

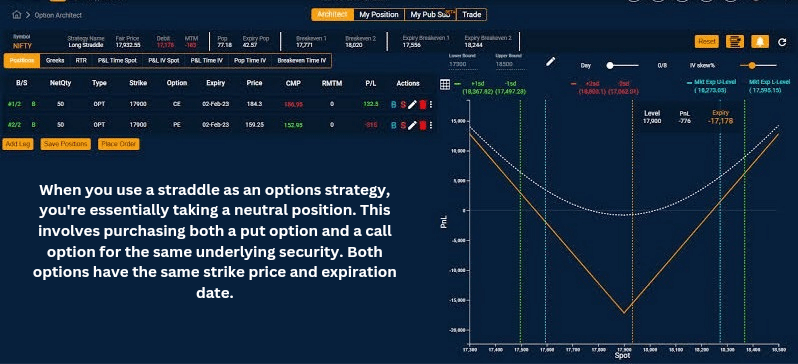

Straddle strategy

A straddle strategy in trading involves buying and selling simultaneously, creating a direction-neutral position. Traders use straddles when they anticipate a significant market move but are uncertain of the direction (up or down).

Here are a couple of strategies you can use on Nadex to potentially profit in various market conditions:

Straddle Strategy with Nadex Call Spread Contracts:

– A straddle strategy is direction-neutral, involving simultaneous buying and selling.

– With Nadex Call Spread contracts, you can set up a straddle strategy effectively.

– Step 1: Simultaneously take a long (buy) and short (sell) position in the same market.

– Step 2: The built-in floor and ceiling levels in call spread contracts offer risk protection for both positions.

– Step 3: No stops are needed, allowing potential profits regardless of market direction.

– Step 4: Be aware of all possible outcomes by reviewing your maximum profit and loss levels.

– This strategy is particularly useful in unpredictable markets.

Strangle Strategy with Nadex Binary Options:

– A strangle strategy is akin to a straddle but utilizes binary options.

– Step 1: Sell an in-the-money (ITM) binary option contract at $75 or higher.

– Step 2: Buy an out-of-the-money (OTM) binary option contract at $25 or lower.

– Step 3: Consider placing limit orders at around 1.5 to 2 times the risk on either side of the trade.

Note: Nadex also offers short-term binary option for fast-paced trading.

Funding

Nadex offers funding options via wire transfer, debit card, and ACH (exclusive to the US). The debit card option is the fastest, with no fees and immediate fund availability in your Nadex account. New debit card deposits require a one-time verification process. However, clients cannot withdraw funds to a debit card.

Wire transfer deposits are processed upon bank notification, typically within 24 hours. Wire withdrawal requests submitted before 4pm ET from Monday to Thursday, or before 3:00pm ET on Friday, are processed the same business day. Requests after these times are processed the next business day. A $25.00 processing fee is applied to wire transfer withdrawals.

As a CFTC-regulated exchange, Nadex is obligated to ensure the safety and security of funds using robust physical, electronic, and procedural safeguards that adhere to or surpass industry standards.

Conclusion

Nadex is a highly regulated and leading exchange to trade binary options, Touch Bracket(knock-outs), and call spread contracts. They provide global clients with flexible in forex trading options, Commodities, and Stock Indices. The Nadex platform is user-friendly and accessible on multiple devices. They offer competitive commission fees and a wide range of educational resources to enhance traders’ knowledge.

Earning money on Nadex necessitates proper knowledge, investment advice and understanding of the platform. Various tips have been discussed to maximize earnings and leverage them to your benefit. It’s important to acknowledge that Nadex, like other binary platforms, has its complexities, making it challenging to profit without a thorough understanding of its workings.

I hope this information proves to be beneficial.

You can check the other blogs related to freelance topic ideas and many more from wealth and health mastery. The more you explore the more you will learn and earn! Good luck!